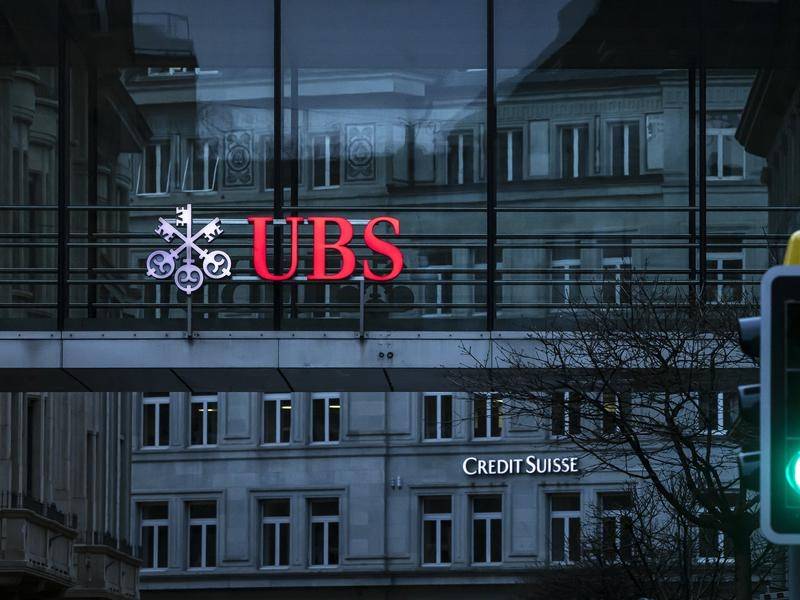

UBS Acquires Credit Suisse: A Historic Deal to Save Swiss Banking and Reshape Global Finance

In a stunning move that has shocked the global financial markets, UBS has agreed to acquire Credit Suisse in a historic deal aimed at saving Swiss banking and reshaping the landscape of global finance. The merger creates a new banking giant with dominant positions in wealth management, investment banking, and asset management, but has drawn mixed reactions from analysts and investors.

UBS has acquired Credit Suisse for $3.23 billion in stock and will take on up to $5.4 billion in losses to save the struggling bank.

The deal was brokered by Swiss authorities to end the crisis of confidence that has engulfed Credit Suisse after the collapse of several US lenders and a series of scandals and losses.

The merger creates a new banking giant with combined assets of over $6 trillion and dominant positions in wealth management, investment banking, and asset management.

The reaction from analysts and investors was mixed, with some praising the deal as a bold move while others criticized it as an unfair bailout that would reward mismanagement at Credit Suisse.

The merger is expected to close by the end of 2023, subject to customary closing conditions, and until then, Credit Suisse will continue to operate in the ordinary course of business and implement its restructuring measures in collaboration with UBS.

In a stunning move that shocked the global financial markets, UBS (UBSG.S) announced on Sunday that it has agreed to buy its rival Credit Suisse (CSGN.S) for 3 billion Swiss francs ($3.23 billion) in stock and take on up to 5 billion francs ($5.4 billion) in losses. The deal, which was brokered by the Swiss authorities, aims to end the crisis of confidence that has engulfed Credit Suisse after the collapse of several US lenders.

Credit Suisse, one of Switzerland’s oldest and most prestigious banks, has been struggling to recover from a series of scandals and losses that have tarnished its reputation and eroded its capital base. The bank was hit hard by the implosion of Archegos Capital Management, a family office that defaulted on billions of dollars of margin calls last year. It also suffered heavy losses from its exposure to Greensill Capital, a supply chain finance firm that filed for bankruptcy in March.

The situation worsened last week when two smaller US banks, Silvergate Capital Corp (SI.N) and Signature Bank (SBNY.O), failed. Credit Suisse had extended loans to both banks and faced significant losses as their assets were seized by regulators. The news triggered a sell-off in Credit Suisse’s shares and bonds, raising fears of a liquidity crunch and a possible contagion effect on other banks.

To prevent further damage to the Swiss economy and banking system, the Swiss Federal Department of Finance, the Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority FINMA intervened and asked Credit Suisse and UBS to enter into merger talks over the weekend. The authorities also changed the country’s laws to bypass a shareholder vote on the deal and offered a $100 billion liquidity line to UBS as part of the agreement.

The merger agreement stipulates that all shareholders of Credit Suisse will receive 1 share in UBS for 22.48 shares in Credit Suisse as merger consideration. This exchange ratio reflects a steep discount to Credit Suisse’s closing price on Friday, when it was valued at about 7.4 billion francs ($11.9 billion). UBS will also assume up to 5 billion francs ($5.4 billion) in losses from Credit Suisse’s troubled assets.

The deal is expected to close by the end of 2023 if possible, subject to customary closing conditions. Until then, Credit Suisse will continue to operate in the ordinary course of business and implement its restructuring measures in collaboration with UBS. UBS is expected to appoint key personnel to Credit Suisse as soon as legally possible. The SNB will grant Credit Suisse access to facilities that provide substantial additional liquidity.

The takeover of Credit Suisse marks a historic event for Switzerland and global finance. It creates a new banking giant with combined assets of over $6 trillion and dominant positions in wealth management, investment banking and asset management. It also ends an era for Credit Suisse, which was founded by industrialist Alfred Escher in 1856 as Schweizerische Kreditanstalt (SKA) and grew into one of Europe’s leading financial institutions.

UBS said it was confident that the merger would create value for its shareholders and stakeholders by generating synergies, enhancing profitability and strengthening resilience. It also said it would continue its commitment to sustainable finance and social responsibility.

Credit Suisse said it regretted having to accept this outcome but recognized that it was necessary given its circumstances. It thanked its employees for their dedication and loyalty during this difficult time.

The reaction from analysts and investors was mixed. Some praised the deal as a bold move that would secure Switzerland’s status as a global financial hub while others criticized it as an unfair bailout that would reward mismanagement at Credit Suisse.

© 2023 Lighthouse Investments Pty Ltd. All Rights Reserved.